简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Housewife Scammed of RM68,242 in Online Investment Scam

Abstract:A 54-year-old housewife has fallen victim to an online investment scam after being misled by an advertisement on social media, resulting in a total loss of RM68,242 over 13 separate transactions.

A 54-year-old housewife has fallen victim to an online investment scam after being misled by an advertisement on social media, resulting in a total loss of RM68,242 over 13 separate transactions.

The incident occurred in June when the woman came across an investment advertisement on Facebook, allegedly promoted by a company. Intrigued by the promise of high returns, she reached out to a Malay female agent claiming to represent the company.

According to the agent, the investment scheme was based on Bitcoin exchange rates and promised substantial returns.

Persuaded by the agent‘s assurances, the victim proceeded to invest. Following the agent’s instructions, she transferred funds in 13 separate transactions to 10 different bank accounts, amounting to a total of RM68,242. The funds came from three of the victims personal savings accounts.

However, by mid-July, the woman had yet to receive any returns or reimbursements. Her suspicions grew when the agent continued to request additional payments under various pretexts.

Realizing she may have been deceived, the victim lodged a police report to seek assistance.

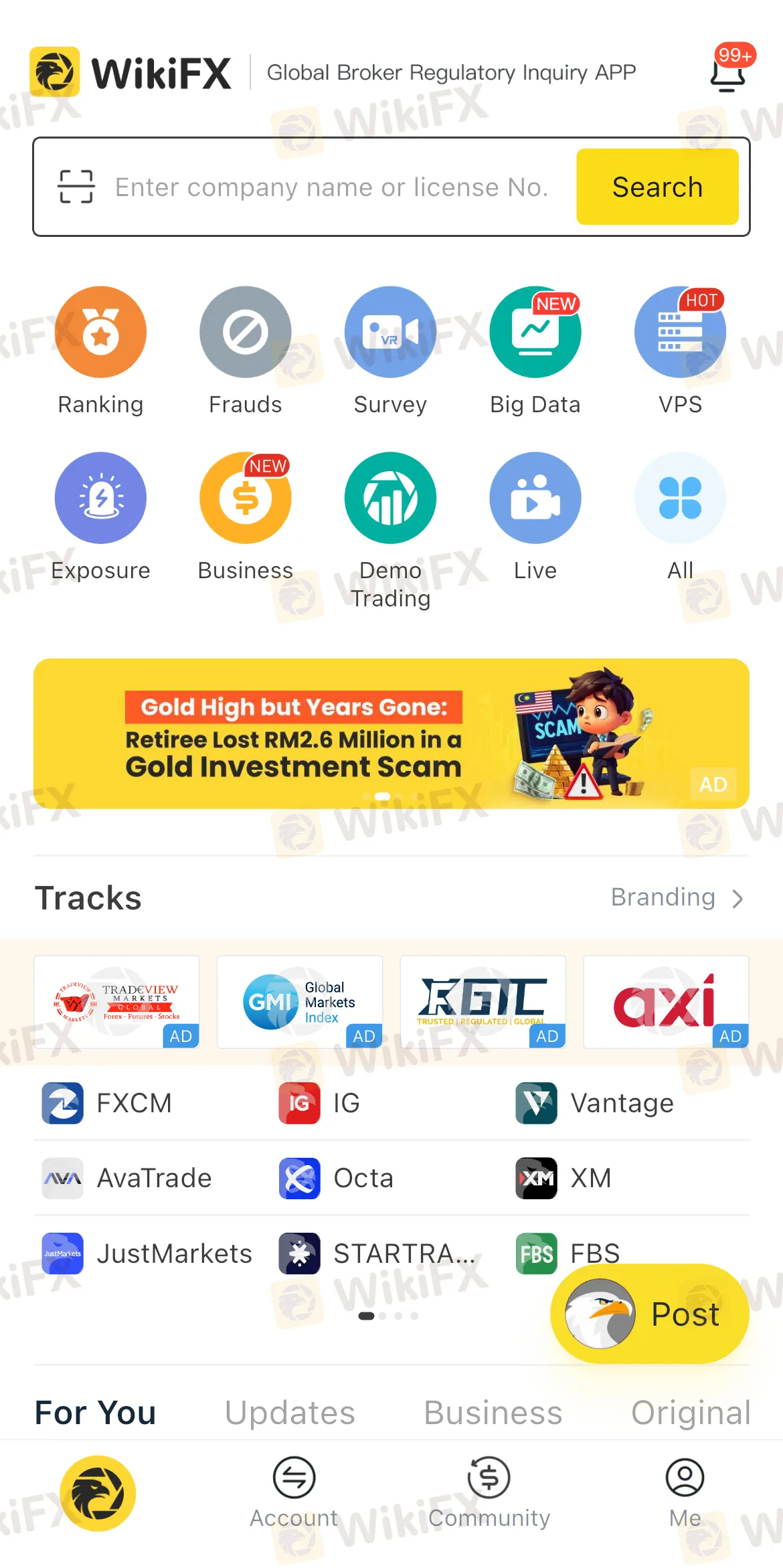

Under no circumstances should you engage with an investment scheme advertised on social media that promises high returns or sounds too good to be true without exercising caution. If in doubt, download the free WikiFX mobile application from Google Play or the App Store. This global broker regulatory query platform, at your fingertips, provides detailed information about brokers, including their regulatory status, customer reviews, and safety ratings. It allows users to verify the legitimacy of investment platforms before committing their money. With access to in-depth insights and risk alerts, WikiFX equips potential investors with the tools to make informed decisions and steer clear of unauthorised or unlicensed entities. By using WikiFX, users can safeguard their savings and avoid the costly traps of fraudulent investment syndicates.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

TradexMarkets: 5 Troubling Signs You Shouldn’t Ignore

Stop! Read this article if you're thinking about using TradexMarkets. There are several warning signs that suggest this broker may not be safe. Check out this article to find out why. Be safe.

Thinking of Investing in TD Ameritrade? Here’s What May Shock You

Experienced both highs and lows with TD Ameritrade in terms of trading experience and customer support? You’re not alone! From humble beginnings to losses and poor experiences, TD Ameritrade has turned out to be a shocking surprise for traders trusting it for wealth creation. The fraudulent broker has moved into the bad books of traders, quickly erasing pleasant memories they had at the beginning. Read on to learn more about it.

Bybit Scam Alert: What Every Trader Must Know!

The cryptocurrency trend is still growing and isn’t going away. More people are investing every day, hoping to profit from this fast-moving market. But opportunity comes with risk. If you want to start trading, make sure you choose a broker that is safe, licensed, and transparent. Remember, if you fall for the Scam brokers like Bybit, they could steal your money. Learn why Bybit is not a safe choice before you invest.

WeTrade Marks 10th Anniversary with Global Campaign, Upgrades and Rewards

The leading financial broker celebrates a decade of excellence with worldwide screen takeovers viewed by millions

WikiFX Broker

Latest News

D. Boral Capital agrees to a fine as a settlement with FINRA

Beware of Fake RS Finance: How to Spot Scams

Fortune Wave Solution: SEC Warns of Investment Scam

XS.com Broker Partnership Expands Liquidity with Centroid Integration

FCA Publishes New Warning List! Check It Now to Stay Safe

EC Markets: A Closer Look at Its Licenses

Housewife Scammed of RM68,242 in Online Investment Scam

From Charts to Profits: Unleashing the Power of Forex Trading Tools

Is TD Ameritrade Safe? How to Spot Fake URLs and Stay Protected

Engineer Loses RM230,000 in “Elite Group” Investment Scam

Currency Calculator