简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Fortrade: A Closer Look at Its Licenses

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Fortrade and its licenses.

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Fortrade and its licenses.

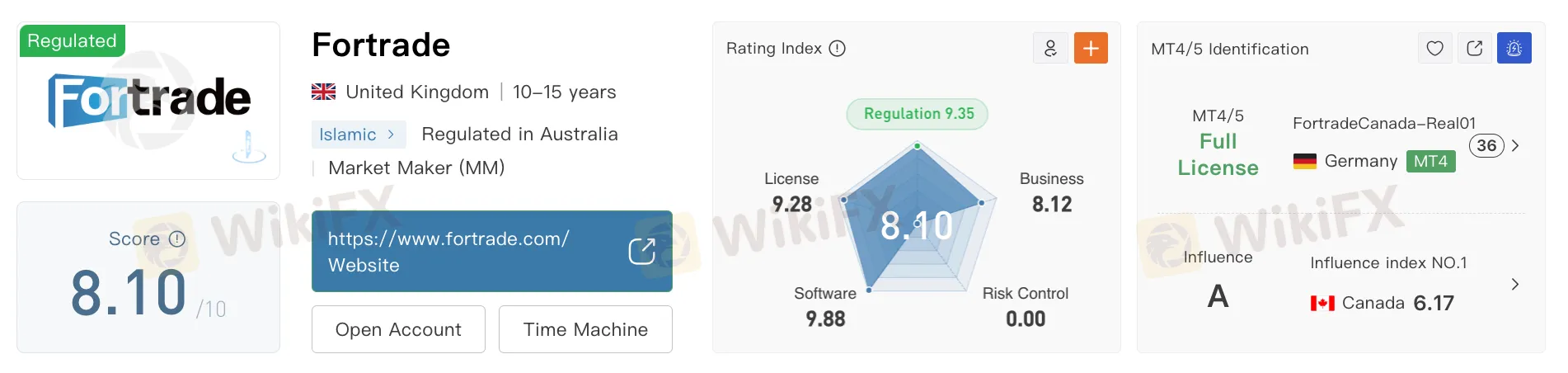

At first glance, Fortrade looks like one of the more reliable brokers in the trading world. It holds licenses from some of the world‘s toughest financial regulators, giving it an image of strength, trust, and legal compliance. Traders are often reassured by its approvals from the UK’s FCA, Australia‘s ASIC, Cyprus’s CySEC, and Canadas CIRO, which are widely known for their strong rules and protection for investors.

In the UK, Fortrade is licensed by the Financial Conduct Authority (FCA) as a Market Maker (License No. 609970). The FCA is known for strict standards in consumer protection and business practices, especially for brokers dealing with everyday traders. It requires high levels of transparency, strong financial health, and fair treatment of clients. These are the rules that help weed out weak or dishonest brokers.

In Australia, Fortrade is regulated by ASIC (License No. 493520), another respected authority. ASIC ensures brokers handle client funds properly, follow fair trading rules, and meet financial standards. Its also active in stopping misleading advertising and unsafe trading practices. Being licensed by both the FCA and ASIC gives Fortrade a strong reputation.

Fortrade also holds a license from CySEC in Cyprus (License No. 385/20). Although CySEC is sometimes seen as slightly less strict than the FCA or ASIC, it still follows EU laws under MiFID II. That means Fortrade must meet rules for capital reserves, risk management, and transparency. This adds to its credibility in Europe.

In North America, Fortrade operates under Canada‘s CIRO, a new regulatory body formed by merging IIROC and MFDA. Although the license number isn’t public, CIRO is known for its careful and investor-focused approach. It watches over brokers and trading platforms across the country, helping to keep the Canadian market safe.

However, despite this strong global regulatory presence, one issue stands out: a revoked license in Belarus.

Fortrade was once licensed by the National Bank of the Republic of Belarus (NBRB), under license No. 193075810. That license has now been revoked. This isn‘t a routine event like ending operations or letting a license expire, as it usually means the broker broke the rules or failed to meet the regulator’s requirements.

Revoking a license isn‘t done lightly. It often follows a pattern of non-compliance, missed deadlines, or problems uncovered during audits. While we don’t know exactly why Fortrade lost this license, the lack of public information makes it more concerning. Without answers, traders are left guessing.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

TradexMarkets: 5 Troubling Signs You Shouldn’t Ignore

Stop! Read this article if you're thinking about using TradexMarkets. There are several warning signs that suggest this broker may not be safe. Check out this article to find out why. Be safe.

Thinking of Investing in TD Ameritrade? Here’s What May Shock You

Experienced both highs and lows with TD Ameritrade in terms of trading experience and customer support? You’re not alone! From humble beginnings to losses and poor experiences, TD Ameritrade has turned out to be a shocking surprise for traders trusting it for wealth creation. The fraudulent broker has moved into the bad books of traders, quickly erasing pleasant memories they had at the beginning. Read on to learn more about it.

Bybit Scam Alert: What Every Trader Must Know!

The cryptocurrency trend is still growing and isn’t going away. More people are investing every day, hoping to profit from this fast-moving market. But opportunity comes with risk. If you want to start trading, make sure you choose a broker that is safe, licensed, and transparent. Remember, if you fall for the Scam brokers like Bybit, they could steal your money. Learn why Bybit is not a safe choice before you invest.

WeTrade Marks 10th Anniversary with Global Campaign, Upgrades and Rewards

The leading financial broker celebrates a decade of excellence with worldwide screen takeovers viewed by millions

WikiFX Broker

Latest News

XS.com Broker Partnership Expands Liquidity with Centroid Integration

EC Markets: A Closer Look at Its Licenses

Housewife Scammed of RM68,242 in Online Investment Scam

From Charts to Profits: Unleashing the Power of Forex Trading Tools

FCA Publishes New Warning List! Check It Now to Stay Safe

Beware of Fake RS Finance: How to Spot Scams

Fortune Wave Solution: SEC Warns of Investment Scam

D. Boral Capital agrees to a fine as a settlement with FINRA

Is TD Ameritrade Safe? How to Spot Fake URLs and Stay Protected

Before You Trade with Quest: 6 Warning Signs to Know

Currency Calculator