简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Exploring the Benefits of Forex Investments

Abstract:The Indian forex market is $60 billion strong, courtesy of the belief that it yields significant returns for investors over time. The visually impressive technical analytic tools give investors an insight into the market behavior. Assessing it through varying currency price movements helps them take an informed call on position and account sizes. Explore this article to know the benefits of forex investments in greater detail.

The Indian forex market is $60 billion strong, courtesy of the belief that it yields significant returns for investors over time. The visually impressive technical analytic tools give investors an insight into the market behavior. Assessing it through varying currency price movements helps them take an informed call on position and account sizes. In this article, we will share the benefits of forex in greater detail.

Here are the Top Advantages of Forex Trading

24x7 Trading Experience

Forex markets operate 24 hours a day, five days a week — offering unmatched flexibility. Unlike stock exchanges with fixed trading hours, forex allows you to trade at your convenience, making it easier to balance trading with a full-time job or other responsibilities.

Easy to Access

Accessing the forex market is easy for traders as they can open a trading account within a day or two and trade with minimum capital. Investors can access online trading platforms offered by a brokerage firm to view real-time currency prices, price charts, tools, and much more. Using these, traders can invest strategically to gain from the price movement.

Low Capital Investment Required

The tight spreads regarding percentage price changes allow traders to invest in forex with little to no capital. Traders with reduced cash can also benefit by initiating margin trading with a high leverage ratio. This remains one of the major benefits of forex trading. Several brokers earn via currency spreads while keeping transactions minimal.

Technical Strategy

The benefits of forex trading lie immensely in technical analysis, showing price charts, histories, and patterns. These give traders an idea of the prevailing market sentiment and demand-supply interactions. Studying these important dynamics and investing accordingly can help investors earn significant returns over time.

High Liquidity

The forex market tends to have more traders than other financial markets globally, allowing it to offer maximum liquidity to investors. As a result, it becomes easy to execute large currency orders without significant price changes. The reduced price manipulation and anomaly risks enable tighter spreads and more effective pricing.

Benefits for Investors Despite Price Fluctuations

The best part about forex trading is that it calms investors despite intense price fluctuations. There are methods like arbitrage and hedging, successfully employed by traders to navigate price fluctuation. An arbitrage is a trading method where investors buy at a lower price in one market and sell it in another market at a higher price. It ensures greater returns for traders. Hedging, on the other hand, is a tool employed to reduce the risks associated with currency price movements, in the case of forex trading. Here, you can offset a position by unleashing the benefit of futures or options. This helps reduce your potential loss.

Wrapping Up

Forex trading can be a powerful addition to your investment portfolio — especially if youre comfortable with some level of risk. Start small, understand the tools, and gradually increase your exposure as your confidence grows. With the right strategy and knowledge, forex can help you unlock meaningful returns over time.

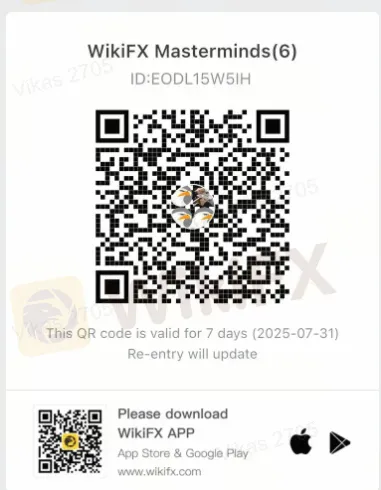

Join WikiFX Masterminds - where the BEST forex minds grace with insights by scanning this QR code.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

TradexMarkets: 5 Troubling Signs You Shouldn’t Ignore

Stop! Read this article if you're thinking about using TradexMarkets. There are several warning signs that suggest this broker may not be safe. Check out this article to find out why. Be safe.

Thinking of Investing in TD Ameritrade? Here’s What May Shock You

Experienced both highs and lows with TD Ameritrade in terms of trading experience and customer support? You’re not alone! From humble beginnings to losses and poor experiences, TD Ameritrade has turned out to be a shocking surprise for traders trusting it for wealth creation. The fraudulent broker has moved into the bad books of traders, quickly erasing pleasant memories they had at the beginning. Read on to learn more about it.

Bybit Scam Alert: What Every Trader Must Know!

The cryptocurrency trend is still growing and isn’t going away. More people are investing every day, hoping to profit from this fast-moving market. But opportunity comes with risk. If you want to start trading, make sure you choose a broker that is safe, licensed, and transparent. Remember, if you fall for the Scam brokers like Bybit, they could steal your money. Learn why Bybit is not a safe choice before you invest.

A Guide to Buy Stop vs Buy Limit in Forex Trading

Want to make a mark in forex trading by seizing hidden growth opportunities or preventing capital loss? Learn the art of locating orders. With an in-depth understanding of order functionality involving the impact on trades, traders can successfully navigate the forex market. As far as buying is concerned, traders need to acquaint themselves with a buy limit and a buy stop. These two orders play a critical role in helping traders enter and exit the market efficiently.

WikiFX Broker

Latest News

XS.com Broker Partnership Expands Liquidity with Centroid Integration

EC Markets: A Closer Look at Its Licenses

Housewife Scammed of RM68,242 in Online Investment Scam

From Charts to Profits: Unleashing the Power of Forex Trading Tools

FCA Publishes New Warning List! Check It Now to Stay Safe

Beware of Fake RS Finance: How to Spot Scams

Fortune Wave Solution: SEC Warns of Investment Scam

D. Boral Capital agrees to a fine as a settlement with FINRA

Is TD Ameritrade Safe? How to Spot Fake URLs and Stay Protected

Before You Trade with Quest: 6 Warning Signs to Know

Currency Calculator