简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

CBCX: A Closer Look at Its Licenses

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about CBCX and its licenses.

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. CBCX is a broker that holds recognized financial licenses in two different jurisdictions.

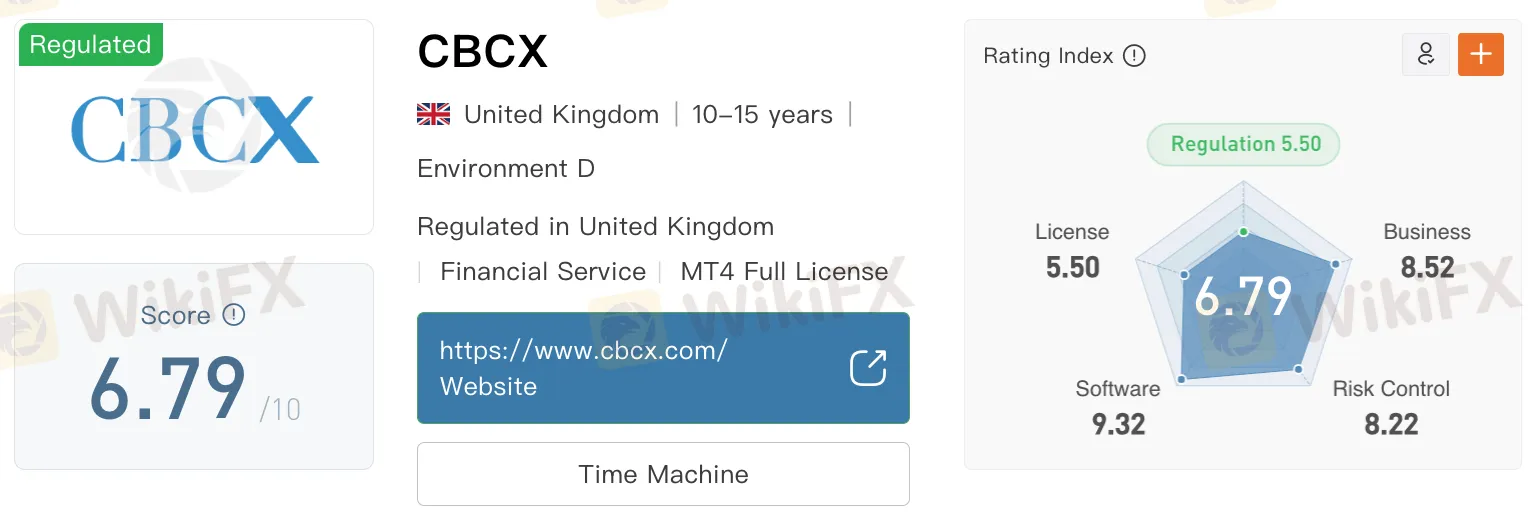

On WikiFX, CBCX holds a score of 6.79 out of 10. This rating reflects a generally stable regulatory framework and active operations, while also noting areas that may require closer review, particularly where a broker operates across multiple jurisdictions with different scopes of regulatory coverage.

CBCX is currently licensed by the Financial Conduct Authority (FCA) in the United Kingdom under license number 572911. The FCA is an independent financial regulatory body responsible for overseeing firms that provide financial services to consumers. FCA-regulated firms are required to comply with strict standards related to transparency, client fund protection, and operational conduct.

In addition to its FCA license, CBCX is also registered with South Africas Financial Sector Conduct Authority (FSCA) under license number 49700. The FSCA is responsible for regulating market conduct among financial institutions and aims to promote fair treatment for financial customers. However, it is noted that CBCX operates beyond the business scope permitted under its FSCA license, which is categorised as a non-forex financial services license. This means that while the broker is listed with the FSCA, it may be offering services not fully covered under its South African authorization.

In summary, CBCX has formal licenses from both the UK‘s FCA and South Africa’s FSCA, which indicates a certain level of regulatory presence. However, the brokers activities exceeding the scope of one of its licenses suggests that traders should take time to understand the specific services being offered and where they fall under regulatory supervision. As always, traders are encouraged to perform due diligence before engaging with any broker, especially when services are offered across multiple regions with varying rules and oversight levels.

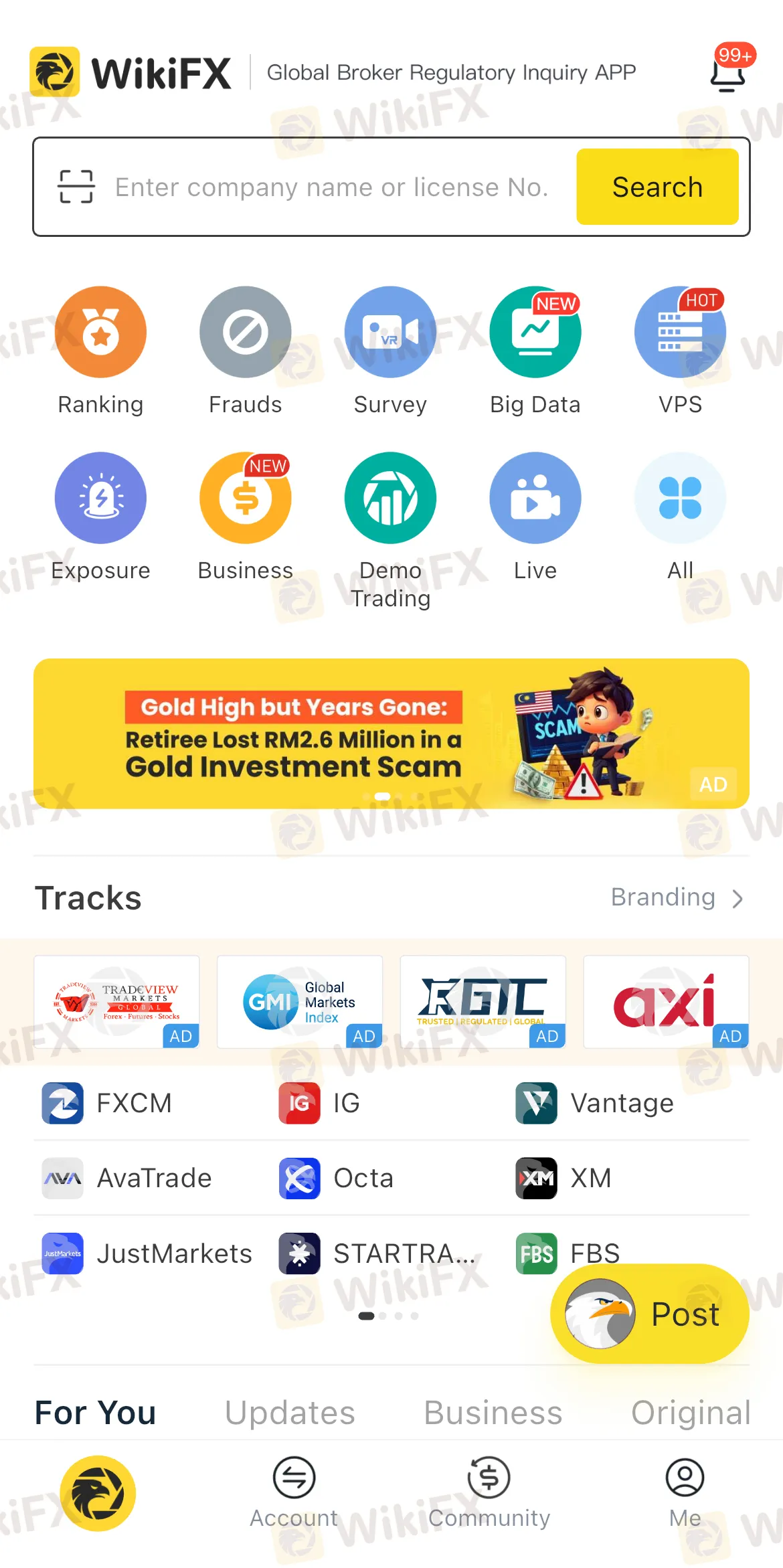

Conducting due diligence before investing is crucial, and independent verification tools such as WikiFX can be instrumental in assessing the legitimacy of brokers and investment firms. The WikiFX mobile application, available on Google Play and the App Store, provides comprehensive insights into brokers regulatory status, customer reviews, and safety ratings. By leveraging such resources, investors can make informed decisions and avoid the financial devastation caused by fraudulent schemes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Plusonetrade Exposed: Promises High Returns, Delivers Only Trade Losses

Do you feel that Plusonetrade only makes you deposit with high-return promises? Does it deny withdrawals or allow you to take away just the principal amount? Have you been witnessing a lack of customer support to address your withdrawal queries at this forex broker? You have unfortunately trusted a fake broker that is operating without a valid license. The scams are obvious as traders are vehemently opposing the foul play committed by Plusonetrade on broker review platforms.

Avoid Losing Money: 6 Red Flags That Make LQH Markets Risky Choice

The only true way to protect your hard-earned money in the forex market is by staying informed and alert. With the growing number of fraudulent brokers, this dynamic and tempting market has become increasingly risky. Awareness is your best defense. This article serves as another important scam alert, to help you stay safe and avoid losing your money.

Most Volatile Currency Pairs You Should Know Before Trading

Do you think that trading in the most volatile currency pairs is a loss-making proposition? Maybe you are missing out on the profit waiting for you! Yes, you still need to be tactical and strategic when opening and closing positions. However, the increased possibility of dramatic price movements in currency pairs opens up avenues for higher profits while also exposing you to market risks. In this article, we will discuss the most volatile forex pairs worldwide. Read on!

Is Learning Forex Trading Online a Good Idea? Pros and Cons Explained

Forex trading is becoming more popular around the world. To help with this, many brokers are offering forex education courses. Some are free, and some are paid. Some brokers even have special academies to teach trading. This trend is growing fast, but the big question is: Is learning forex online really helpful? And what are the risks that you may not know about? I

WikiFX Broker

Latest News

D. Boral Capital agrees to a fine as a settlement with FINRA

Beware of Fake RS Finance: How to Spot Scams

Fortune Wave Solution: SEC Warns of Investment Scam

XS.com Broker Partnership Expands Liquidity with Centroid Integration

FCA Publishes New Warning List! Check It Now to Stay Safe

EC Markets: A Closer Look at Its Licenses

Housewife Scammed of RM68,242 in Online Investment Scam

From Charts to Profits: Unleashing the Power of Forex Trading Tools

Is TD Ameritrade Safe? How to Spot Fake URLs and Stay Protected

Engineer Loses RM230,000 in “Elite Group” Investment Scam

Currency Calculator