简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What Xtreme Markets Isn’t Telling You About Its Regulation

Abstract:Xtreme Markets, a forex and CFD broker, operates under a licence issued by the Financial Services Commission (FSC) of Mauritius. While this regulatory stamp may appear reassuring at first glance, a closer look at the nature of offshore licences reveals several critical factors that investors should not ignore.

Xtreme Markets, a forex and CFD broker, operates under a licence issued by the Financial Services Commission (FSC) of Mauritius. The company holds a Retail Forex Licence with registration number GB22200951. While this regulatory stamp may appear reassuring at first glance, a closer look at the nature of offshore licences reveals several critical factors that investors should not ignore.

The FSC of Mauritius is categorised as an offshore regulator. Offshore jurisdictions typically offer lower entry barriers for brokers, including less stringent capital requirements, minimal ongoing supervision, and limited mechanisms for investor redress in cases of misconduct. This regulatory leniency is often used by firms seeking operational freedom while still presenting a façade of legitimacy to unsuspecting clients.

Although Xtreme Markets is technically regulated, the offshore nature of its licence introduces a significant level of underlying risk. Offshore regulators are not generally known for active enforcement or tight oversight, which means that client protection may be minimal. In the event of a dispute or broker insolvency, recovering funds can become a lengthy and uncertain process.

Onshore vs Offshore Forex Broker Licences: Why the Difference Matters

Understanding the difference between onshore and offshore regulation is essential for any trader evaluating a broker. Onshore regulators, such as the UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Commodity Futures Trading Commission (CFTC) in the United States, are known for strict standards. These include segregation of client funds, compensation schemes, transparent fee disclosures, and strong compliance checks.

In contrast, offshore regulators typically lack the infrastructure and legal frameworks necessary to provide comparable investor protection. This gap is often exploited by brokers that wish to operate internationally while avoiding the costs and compliance burdens associated with reputable onshore jurisdictions. In many cases, brokers registered offshore may still actively solicit clients in regulated countries without being authorised to do so, raising serious concerns about transparency and legal standing.

This is not to say that every offshore-licensed broker operates unethically, but the lack of robust oversight significantly increases the risk for investors. Without comprehensive regulation, the brokers internal practices, such as how client funds are handled or how trades are executed, remain largely unverified by a credible third party.

While Xtreme Markets may present itself as a regulated broker, its status as an offshore-licensed entity under the Mauritius FSC highlights important limitations in terms of regulatory assurance and investor protection. Traders considering such brokers should exercise heightened caution and ensure they fully understand the nature of the regulatory environment in which the broker operates.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

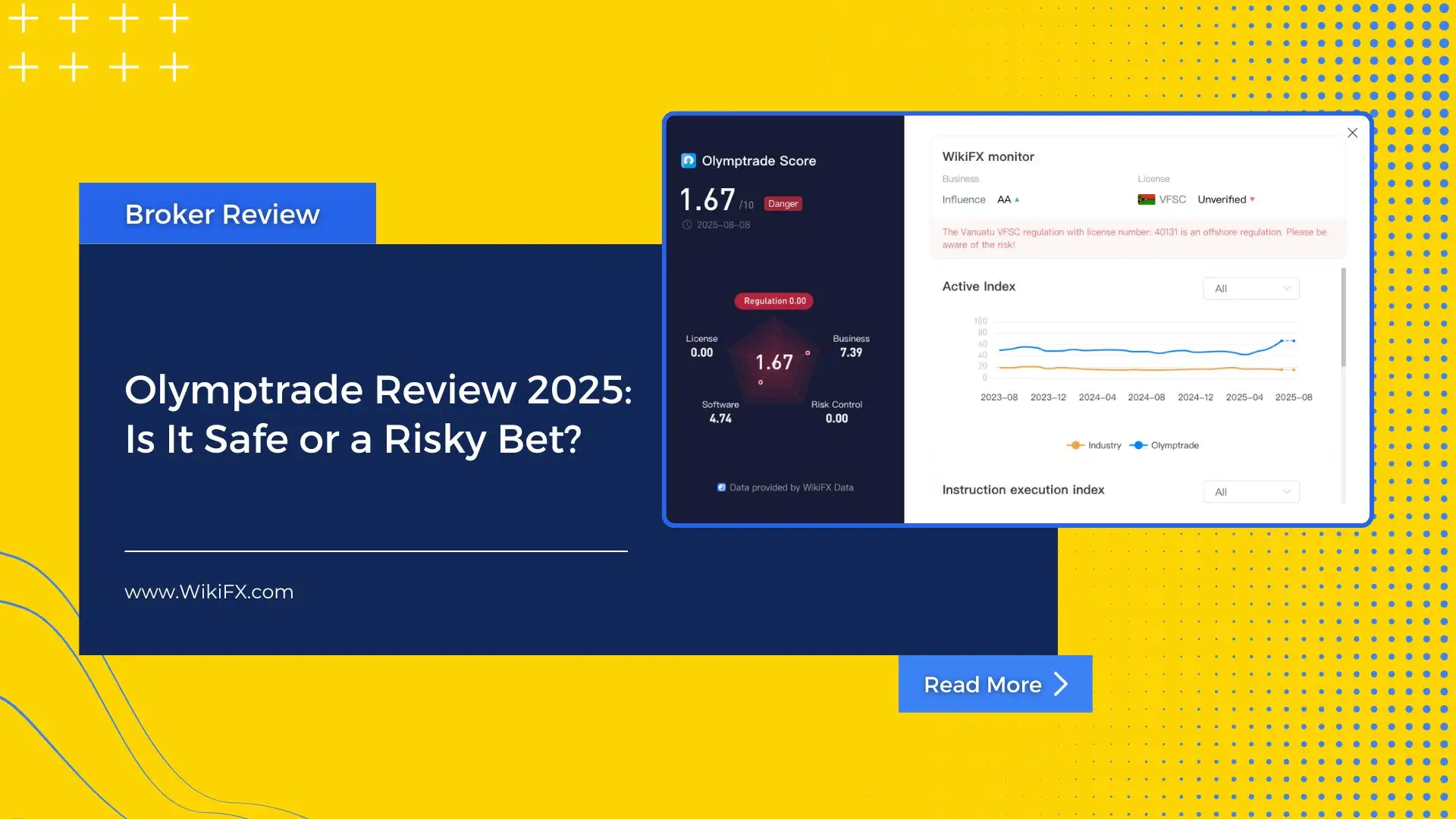

Olymptrade Review 2025: Is It Safe or a Risky Bet?

Olymptrade review based on WikiFX data: operates without valid regulation, offers web and mobile trading, but faces multiple user complaints.

Charles Schwab Forex Review 2025: What Traders Should Know

An updated 2025 review of Charles Schwab’s forex profile, covering rating, regulatory history, platform offering, and retail suitability.

Investing in Coinexx? Think Again Before Your Account Balance Hits ZERO

Coinexx has emerged as a nightmare for traders who once saw potential and profit in its platform. The problems lie in its lack of transparency, which has left many investors with a ZERO balance. Scamming investors by employing fraudulent tactics and introducing bogus trading rules is increasingly becoming its status symbol. The endless negative reviews of this scam broker are trending on various platforms. To expose the troubling investor experiences, we’ve compiled sharp complaints from verified users of Coinexx. Read on!

UnityFXLive: How This Broker Scammed Over $350,000 ? Know the Red Flags

On August 4, 2025 Indian police arrested two men for running a fake forex trading scam under the name UnityFXLive.com. The suspects were caught operating from a rented office in Goregaon, Mumbai. During questioning, they revealed the name of a third person who is believed to be the mastermind behind the scam. He is currently on the run. The scammers promised people high returns on forex investments, but instead of doing real trading, they stole the money using fake online platforms.

WikiFX Broker

Latest News

Charles Schwab Forex Review 2025: What Traders Should Know

Olymptrade Review 2025: Is It Safe or a Risky Bet?

The Debt And Deficit Problem Isn't What You Think

Currency Calculator