简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trade Nation: A Closer Look at Its Licences

Abstract:In an industry where safety and transparency are essential, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Trade Nation and its licenses.

When choosing an online trading broker, one of the most important things to check is whether they are properly licensed and regulated. A strong licence helps protect traders and ensures the broker follows fair rules. This is where platforms like WikiFX come in. They help traders check if a broker is safe to use by reviewing its licences, complaints, and overall reputation.

One broker that has gained attention is Trade Nation. According to WikiFX, it has a high WikiScore of 8.99 out of 10, showing that it is generally trusted and well-regulated. But its still important to look more closely at what this score is based on.

Trade Nation holds licences in several countries. In the United Kingdom, it is licensed by the Financial Conduct Authority (FCA) with licence number 525164. It is also licensed in Australia by the Australian Securities and Investments Commission (ASIC) under number 000422661. Both of these regulators are known for having strict rules, which is a good sign for traders.

In both the UK and Australia, Trade Nation is licensed as a Market Maker. This means the broker can set prices and take the other side of a trade. This setup is common, but some traders prefer other models, like STP (Straight Through Processing), where trades go straight to the market without the broker stepping in.

Trade Nation also has licences in offshore locations. It holds a Retail Forex Licence from the Seychelles Financial Services Authority and another from the Securities Commission of The Bahamas, with licence number SIA-F216. These licences allow the broker to operate internationally, but these regulators are not as strict as the FCA or ASIC. That means they may offer less protection for traders.

In South Africa, Trade Nation is licensed by the Financial Sector Conduct Authority (FSCA) under licence number 49846. However, WikiFX reports that Trade Nation may be working outside the limits of this licence, which is something traders in that region should be aware of.

To sum up, Trade Nation is a well-regulated broker with licences from respected regulators in the UK and Australia, as well as offshore bodies. Still, its important for traders to look at where the broker is licensed and what kind of licence it holds. Being informed helps you trade with more safety and confidence.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

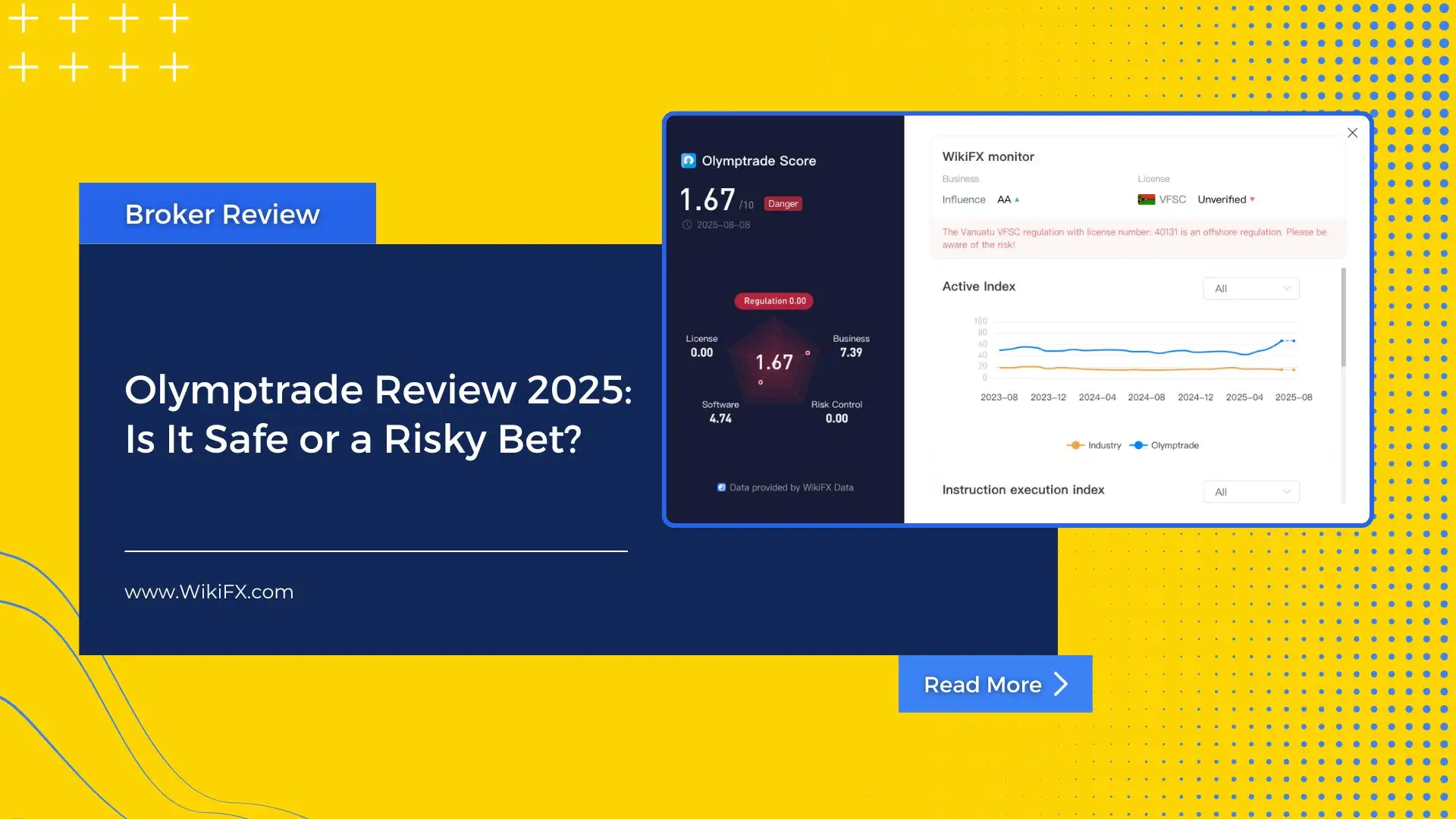

Olymptrade Review 2025: Is It Safe or a Risky Bet?

Olymptrade review based on WikiFX data: operates without valid regulation, offers web and mobile trading, but faces multiple user complaints.

Charles Schwab Forex Review 2025: What Traders Should Know

An updated 2025 review of Charles Schwab’s forex profile, covering rating, regulatory history, platform offering, and retail suitability.

Investing in Coinexx? Think Again Before Your Account Balance Hits ZERO

Coinexx has emerged as a nightmare for traders who once saw potential and profit in its platform. The problems lie in its lack of transparency, which has left many investors with a ZERO balance. Scamming investors by employing fraudulent tactics and introducing bogus trading rules is increasingly becoming its status symbol. The endless negative reviews of this scam broker are trending on various platforms. To expose the troubling investor experiences, we’ve compiled sharp complaints from verified users of Coinexx. Read on!

UnityFXLive: How This Broker Scammed Over $350,000 ? Know the Red Flags

On August 4, 2025 Indian police arrested two men for running a fake forex trading scam under the name UnityFXLive.com. The suspects were caught operating from a rented office in Goregaon, Mumbai. During questioning, they revealed the name of a third person who is believed to be the mastermind behind the scam. He is currently on the run. The scammers promised people high returns on forex investments, but instead of doing real trading, they stole the money using fake online platforms.

WikiFX Broker

Latest News

Charles Schwab Forex Review 2025: What Traders Should Know

Olymptrade Review 2025: Is It Safe or a Risky Bet?

The Debt And Deficit Problem Isn't What You Think

Currency Calculator