简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

One Click on Facebook Cost a 77-Year-Old Over RM100,000

Abstract:A 77-year-old man in Kuala Terengganu lost more than RM100,000 to a foreign currency exchange (forex) investment scam that began with a Facebook friend request.

A 77-year-old man in Kuala Terengganu lost more than RM100,000 to a foreign currency exchange (forex) investment scam that began with a Facebook friend request.

According to Kuala Terengganu police chief ACP Azli Mohd Noor, the victim was introduced to the scheme on 28 May by the sister of a woman he had befriended on Facebook. Trusting the connection, he agreed to join the purported investment programme.

In the first week, he deposited RM3,000 into what he believed was his forex account. The fraudsters provided a fake receipt as proof of the deposit and later sent a screenshot via WhatsApp showing supposed profits. Encouraged by these apparent gains, he committed an additional RM69,000 to the scheme.

When the victim attempted to withdraw his profits, he was told he needed to make another payment of RM35,844. The perpetrators claimed this was required because his earnings involved “elements of money laundering” and had to be cleared before withdrawal. Realising he had been deceived, the man lodged a police report. The case is now under investigation under Section 420 of the Penal Code, which covers cheating and dishonestly inducing delivery of property.

The growing vulnerability of older adults to sophisticated online investment scams remains a serious concern in Malaysia. Many retirees have accumulated substantial savings or pension funds, making them appealing targets for fraudsters who promise high returns through bogus investments such as fake bonds, cryptocurrency schemes, or unrealistic trading opportunities.

In addition to financial means, older investors often face a knowledge gap in navigating online threats. While younger generations have grown up with the internet and are generally more familiar with digital red flags, many older individuals may lack the experience to identify counterfeit websites, phishing messages, or fraudulent trading platforms. Even regular internet users in this age group can be caught off guard by well-designed but deceptive interfaces.

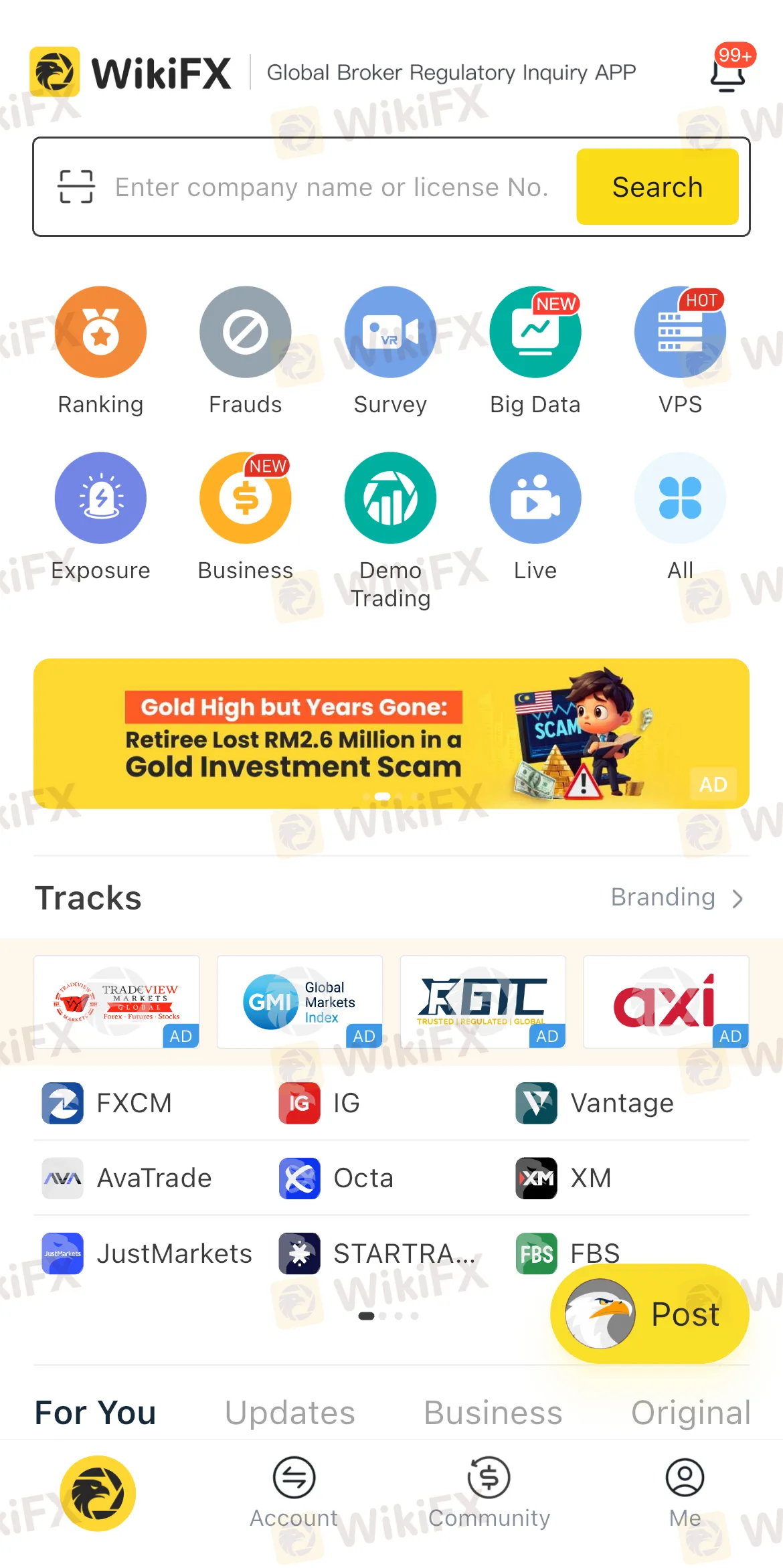

Industry experts stress the importance of verifying the legitimacy of brokers and financial platforms before investing. One tool available to the public is WikiFX, a platform offering a database of global broker profiles, regulatory status updates, and user reviews. The applications risk ratings and alerts flag unlicensed or suspicious entities, enabling investors to recognise warning signs before parting with their money.

By conducting a quick background check on a broker through services like WikiFX, individuals can avoid falling into the traps of unregulated schemes. This simple step can help safeguard savings that may have taken decades to build. The application is available for free on both the App Store and Google Play. There is nothing to lose and everything to gain with this free app!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Investing in Coinexx? Think Again Before Your Account Balance Hits ZERO

Coinexx has emerged as a nightmare for traders who once saw potential and profit in its platform. The problems lie in its lack of transparency, which has left many investors with a ZERO balance. Scamming investors by employing fraudulent tactics and introducing bogus trading rules is increasingly becoming its status symbol. The endless negative reviews of this scam broker are trending on various platforms. To expose the troubling investor experiences, we’ve compiled sharp complaints from verified users of Coinexx. Read on!

UnityFXLive: How This Broker Scammed Over $350,000 ? Know the Red Flags

On August 4, 2025 Indian police arrested two men for running a fake forex trading scam under the name UnityFXLive.com. The suspects were caught operating from a rented office in Goregaon, Mumbai. During questioning, they revealed the name of a third person who is believed to be the mastermind behind the scam. He is currently on the run. The scammers promised people high returns on forex investments, but instead of doing real trading, they stole the money using fake online platforms.

FXPRIMUS Exposed: Withdrawal Denials, Account Blocks & Other Alarming Issues

Have your fund withdrawal applications been constantly denied by FXPRIMUS? Does the forex broker inappropriately block your trading account? Are your deposits disappearing without reaching your trading account? There’s something seriously wrong with this forex broker, whose track record keeps getting worse by the day. Many traders have expressed their anguish on several broker review platforms. While reading those reviews, we could not resist exposing this broker. Check out how traders have criticized FXPRIMUS for its illicit acts.

FXPRIMUS Exposed: Withdrawal Denials, Account Blocks & Other Alarming Issues

Have your fund withdrawal applications been constantly denied by FXPRIMUS? Does the forex broker inappropriately block your trading account? Are your deposits disappearing without reaching your trading account? There’s something seriously wrong with this forex broker, whose track record keeps getting worse by the day. Many traders have expressed their anguish on several broker review platforms. While reading those reviews, we could not resist exposing this broker. Check out how traders have criticized FXPRIMUS for its illicit acts.

WikiFX Broker

Latest News

Forex Swaps Explained in 5 Minutes – Everything You Need to Know

Telegram vs WhatsApp vs Discord: Which Platform Is Best for Forex Signals?

Investment Scam Alert: FCA Identifies 15 Scam Brokers

BaFin Issues Consumer Alerts Against Unauthorised Platforms

Retired Man Loses Life Savings to ‘Sister Duo’ in Forex Scam

Exploring Laxmii Forex: Kharadi's Financial Hub

TradexMarkets: 5 Troubling Signs You Shouldn’t Ignore

A Guide to Buy Stop vs Buy Limit in Forex Trading

SEC Implements New Rules for Crypto-Asset Service Providers

Binance Users Convert Crypto and Withdraw Instantly to Mastercard

Currency Calculator