简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

$1.1 Million Default Judgement Passed Against Keith Crews in Stemy Coin Fraud Scheme

Abstract:A Georgia-based federal court has passed a $1.1 million default judgment against Keith Crews on June 3, 2025, in the Stemy Coin Fraud Scheme. Read on to know more.

A Georgia-based federal court has passed a $1.1 million default judgment against Keith Crews on June 3, 2025, in the Stemy Coin Fraud Scheme. Judge Tiffany Johnson while passing the order mandated Crews to forfeit $530,000 in ill-gotten proceeds, a civil penalty worth $530,000, and a prejudgement interest charge of $50,878. Crews was permanently banned from offering securities as he ignored the U.S. Securities and Exchange Commission) August 2023 complaint.

Revealing the Fraud Game Through Stemy Coin

Crews purportedly raised $800,000 from around 200 investors by selling Stemy Coin from October 2019 to May 2021. He falsely represented that Stemy Coin was built using stem cell technology and hard assets such as gold. He issued marketing materials and direct solicitations that claimed partnerships with functional laboratories and doctors. However, nothing of that sort was prevalent. Crews used personal connections to build trust across African-American community organizations and church networks and defaulted with them.

The SEC complaint explains the illegitimate approach Crews adopted to build his businesses. Stem Biotech and Four Square Biz were built to look legitimate. He made dividend and coin appreciation promises through stem cell treatments and proprietary blockchain banking systems. However, the official investigation didnt find any products, labs or partnerships.

More Breakthroughs into the Stemy Coin Fraud Scheme

The investigation found a complete fabrication regarding the Stemy Coin‘s $0.001 valuation per token. There was nothing valued against the coin. Investors were convinced that their funds would enable advanced medical research. However, bank records told a different story. Crews backtracked by diverting proceeds for personal purposes such as buying luxury items. State regulators received official complaints arising from unpaid bills. The order further revealed a chain of ghost partnerships and fake financial reports. Crews refused to respond to the lawsuit filed against him. That only accelerated the default judgment, bypassing a trial that might have revealed additional liabilities. The Stemy Coin Fraud Scheme adds to the list of SEC’s crypto enforcement actions led by Chair Paul Alkins. Alkins has expressed the need for a clear policy to litigation since assuming office at the year beginning. While Coinbase and Uniswap were cleared of the charges leveled against them, the default judgment passed against Crews reaffirms the SECs commitment to crack down on obvious fraudulent activities.

The Chances of Investors Receiving Money are Slim

Although the federal court passed the $1.1 million default judgment against Crews, the chances of investors receiving their money are less. As per public records, Crews does not have visible assets barring a mortgaged property in Kennesaw, Georgia. While the law pursuit of disgorgement, a restitution of net profits, would help investors receive their sums in dollars, Crews non-appearance in court and his no legal representation hint at slim recovery possibilities.

The Voice of Due Diligence on Cryptocurrency Investments Become Louder

The Stemy Coin Fraud Scheme has reignited talks around the need for due diligence on cryptocurrency investments. The Stemy Coin scam shares insights into risks in projects that have been audited by a third party or don‘t have any open roadmap record. Crews promoted the fraudulent scheme to non-accredited investors, a lot of them didn’t have institutional-grade research platform access, as per the litigation order passed by the SEC. With such access, these investors could have easily evaded the financially tragic incident.

The matter has made cryptocurrency investor groups demand increased investor education to prevent such fraudulent schemes. Blockchain analytics, however, report increased scrutiny of low-cap tokens promoting absurd medical or AI integration promises.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

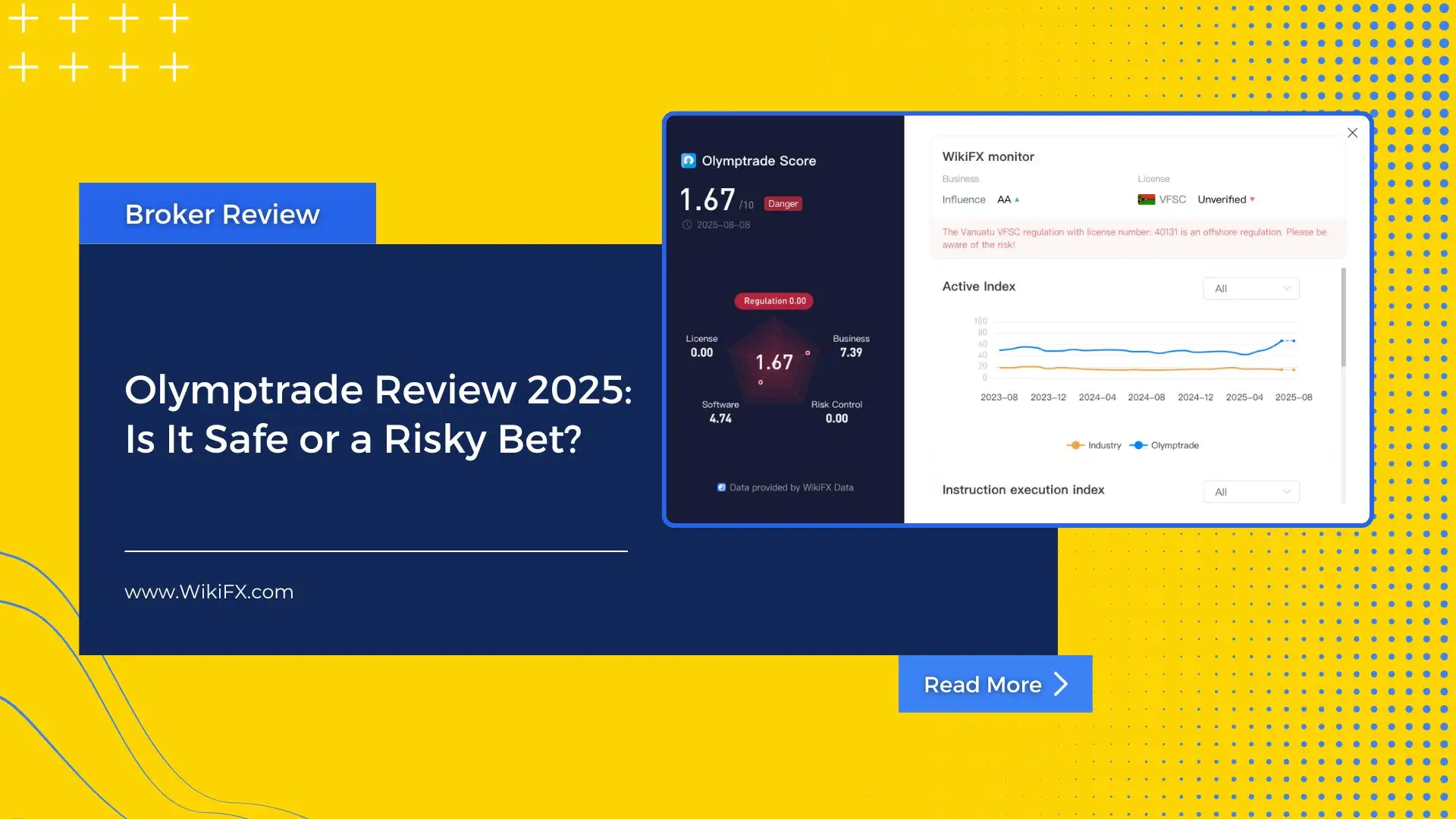

Olymptrade Review 2025: Is It Safe or a Risky Bet?

Olymptrade review based on WikiFX data: operates without valid regulation, offers web and mobile trading, but faces multiple user complaints.

Charles Schwab Forex Review 2025: What Traders Should Know

An updated 2025 review of Charles Schwab’s forex profile, covering rating, regulatory history, platform offering, and retail suitability.

Investing in Coinexx? Think Again Before Your Account Balance Hits ZERO

Coinexx has emerged as a nightmare for traders who once saw potential and profit in its platform. The problems lie in its lack of transparency, which has left many investors with a ZERO balance. Scamming investors by employing fraudulent tactics and introducing bogus trading rules is increasingly becoming its status symbol. The endless negative reviews of this scam broker are trending on various platforms. To expose the troubling investor experiences, we’ve compiled sharp complaints from verified users of Coinexx. Read on!

UnityFXLive: How This Broker Scammed Over $350,000 ? Know the Red Flags

On August 4, 2025 Indian police arrested two men for running a fake forex trading scam under the name UnityFXLive.com. The suspects were caught operating from a rented office in Goregaon, Mumbai. During questioning, they revealed the name of a third person who is believed to be the mastermind behind the scam. He is currently on the run. The scammers promised people high returns on forex investments, but instead of doing real trading, they stole the money using fake online platforms.

WikiFX Broker

Latest News

Charles Schwab Forex Review 2025: What Traders Should Know

Olymptrade Review 2025: Is It Safe or a Risky Bet?

The Debt And Deficit Problem Isn't What You Think

Currency Calculator