简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Weltrade: The Broker With Revoked Licences and a Failing Score

Abstract:With revoked licences, misleading regulatory claims, and a dangerously low WikiScore, Weltrade may be exposing unsuspecting traders to far more risk than they realise. Here’s what every investor needs to know.

Weltrade, a forex and CFD broker operating globally, has recently come under scrutiny for a series of troubling regulatory issues that raise serious concerns about its credibility and transparency. Originally registered in Saint Vincent and the Grenadines, Weltrade offers trading in forex, metals, indices, commodities, and stock CFDs. Despite its widespread presence, the broker has received a dismal WikiScore of just 2.50 out of 10, casting doubt on its trustworthiness in the financial markets.

Though the company claims to be regulated by the Belarusian NBRB, Belize FSC, and South Africa‘s FSCA, further investigation reveals that these regulatory statuses are far from standard. In fact, multiple authoritative bodies have raised red flags regarding Weltrade’s operations.

One of the most significant concerns is that the Securities Commission Malaysia has officially disclosed Weltrade, placing it on an alert list for potential risks to investors. Such disclosures typically indicate regulatory breaches or suspicious practices that merit caution.

Further investigations have revealed that the Belize Financial Services Commission (FSC), which had once granted Weltrade a licence under the number IFSC/60/350/TS/17, has revoked the licence. Offshore regulations like Belizes are already considered to offer weaker oversight, but the revocation adds a further layer of risk.

Similarly, the Belarus NBRB, which had registered Weltrade under licence number 192727233, has also revoked its regulatory approval. This development highlights serious compliance issues that traders cannot afford to ignore.

Adding to these concerns is the broker‘s presence in South Africa, where it claims to operate under the Financial Sector Conduct Authority (FSCA) with licence number 50691. However, it has been confirmed that Weltrade’s activities exceed the scope allowed under this regulation, suggesting that the broker may be operating in violation of local financial laws.

In addition, the broker reportedly holds a Non-Forex licence from the US National Futures Association (NFA) under UNFX, which does not cover the full range of services it appears to offer. This gap between the claimed regulatory coverage and actual authorised activities presents another layer of risk for unsuspecting traders.

Taken together, these factors paint a concerning picture. A low WikiScore, combined with revoked licences, abnormal regulatory statuses, and misleading compliance claims, makes Weltrade a high-risk broker in the eyes of industry observers.

Investors are strongly advised to exercise extreme caution and conduct thorough due diligence before engaging with Weltrade.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

OANDA Japan Mandates 2FA for Enhanced Trading Platform Security

OANDA Japan will implement mandatory 2FA using Google Authenticator in 2025 to boost trading platform security, protecting against phishing and SIM swap attacks.

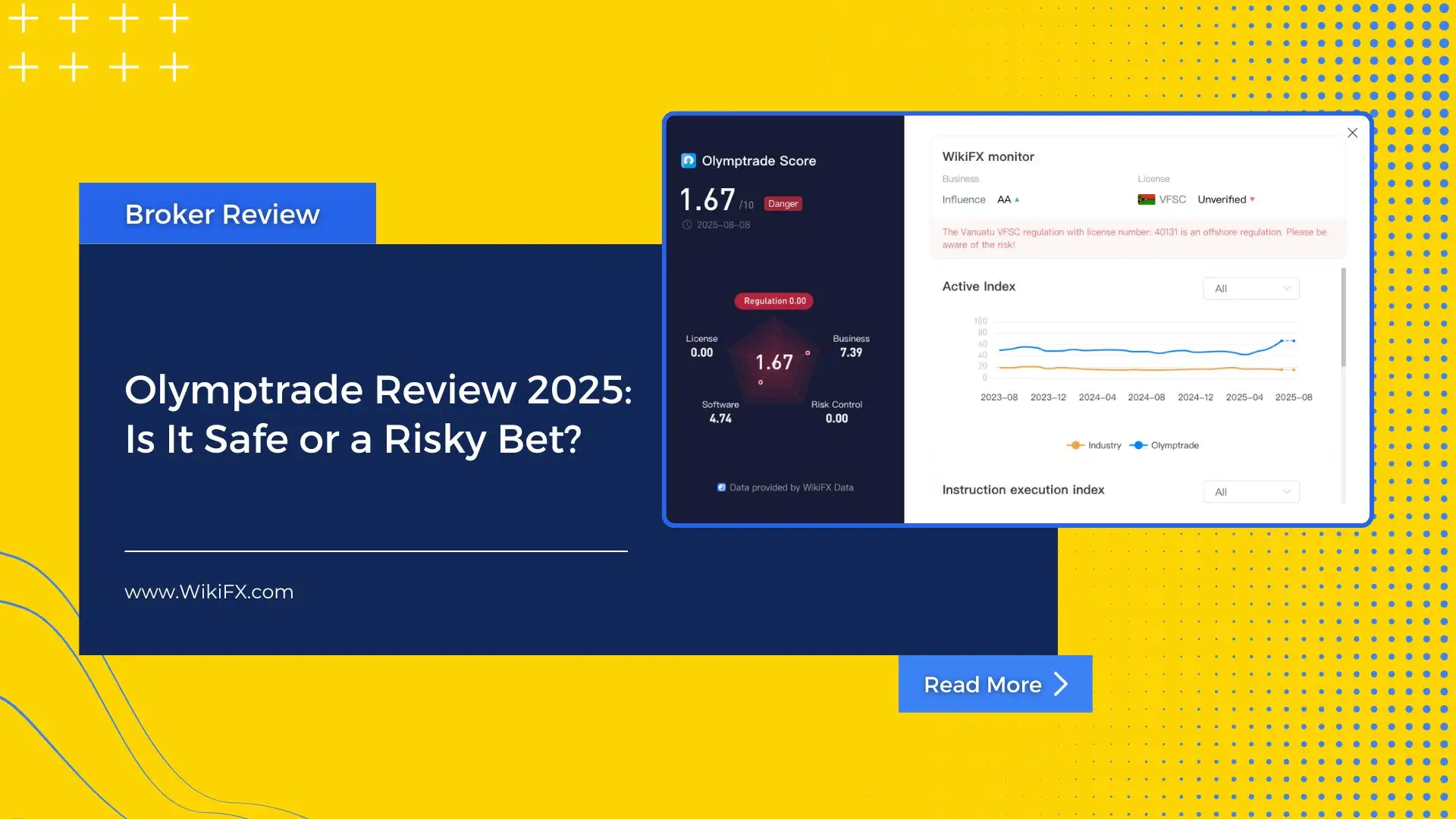

Olymptrade Review 2025: Is It Safe or a Risky Bet?

Olymptrade review based on WikiFX data: operates without valid regulation, offers web and mobile trading, but faces multiple user complaints.

Charles Schwab Forex Review 2025: What Traders Should Know

An updated 2025 review of Charles Schwab’s forex profile, covering rating, regulatory history, platform offering, and retail suitability.

Investing in Coinexx? Think Again Before Your Account Balance Hits ZERO

Coinexx has emerged as a nightmare for traders who once saw potential and profit in its platform. The problems lie in its lack of transparency, which has left many investors with a ZERO balance. Scamming investors by employing fraudulent tactics and introducing bogus trading rules is increasingly becoming its status symbol. The endless negative reviews of this scam broker are trending on various platforms. To expose the troubling investor experiences, we’ve compiled sharp complaints from verified users of Coinexx. Read on!

WikiFX Broker

Latest News

Charles Schwab Forex Review 2025: What Traders Should Know

Olymptrade Review 2025: Is It Safe or a Risky Bet?

The Debt And Deficit Problem Isn't What You Think

OANDA Japan Mandates 2FA for Enhanced Trading Platform Security

Currency Calculator